Ur-Energy Inc. has provided updates for 2025 Q1 from Lost Creek and Shirley Basin....

US tariffs could drive up the costs for a planned nuclear power project in Michigan, according to the South Korean firm building t...

Vietnam has officially approved a revised version of its national power development plan, allocating US$136 billion by 2030 to str...

USA: Ur-Energy Provides Production and Construction Updates for 2025 Q1https://t.co/TeM6cFKQ66#uranium #cleanenergyeconomy

— TradeTech (@U3O8TradeTech) April 17, 2025

January 10, 2025 – TradeTech "Spotlight Interview" with Radiant

March 25, 2024 – TradeTech’s Treva Klingbiel Participates in enCore Energy’s Inaugural Investor Day

March 21, 2024 – Bloomberg: Uranium’s 22% Price Plunge Is Bottoming Out on Nuclear Future

August 18, 2023 – Unmasking Market Dynamics: Uranium’s Rollercoaster Ride

June 6, 2023 – TradeTech President Treva Klingbiel Addresses WNFM International Conference

April 20, 2023 – WNFC 2023 Panel Moderated by TradeTech President Treva Klingbiel

Oct 17, 2022 – TradeTech President Treva Klingbiel Serves as Moderator for NEI Panel

Jun 7, 2022 – TradeTech President Treva Klingbiel Joins WNFM Panel Discussion

January 30, 2025 - The Nuclear Review, January 2025—TradeTech “Spotlight Interview” with Nuclearelectrica—A Story of Nuclear Power’s Remarkable Comeback in Romania

The January issue of TradeTech’s monthly magazine The Nuclear Review featured a “Spotlight Interview” with Mr. Cosmin Ghita, CEO of Romania’s National Company “Nuclearelectrica” SA, which owns and operates the nation’s sole nuclear power facility, the two-unit Cernavoda Nuclear Power Plant.

Romania is planning to expand its nuclear power program, including both large reactors (two additional CANDU reactors—Cernavoda Units 3 & 4) and small modular reactors. Nuclearelectrica also plans to extend the operating life of Cernavoda Unit 1 to 60 years.

Mr. Ghita shared his views on various opportunities and challenges confronting the company and also the global nuclear industry. [top]

January 7, 2025 - TradeTech “Spotlight Interview” with Radiant

TradeTech's Nuclear Market Review has featured a “Spotlight Interview” Radiant CEO Doug Bernauer, who highlights the clean energy startup’s nuclear power activities and goals.

The US-based company is building a nuclear microreactor as a climate friendly alternative to diesel generators. Kaleidos, a 1 MW portable microreactor will bring power to remote regions around the world and provide backup power for life-saving applications in hospitals or disaster-relief scenarios. The company plans to test its development reactor by 2026 and, if successful, it will be the first new commercial reactor design in the USA to achieve a fueled test in over 50 years. [top]

December 31, 2024 - TradeTech's Production Cost Indicator Edges Upward with Focus on Newly Emerging Projects in 2025

TradeTech’s monthly Production Cost Indicator (PCI) increased 0.3 percent (US$0.20) to $58.40 per pound U3O8 for December 2024—5.4 percent ($3.00) higher than last year’s equivalent of $55.40 and the highest value since the Indicator’s inception in April 2020.

The December PCI value of $58.40 per pound U3O8 continues to reflect a combination of circumstances affecting the future supply/demand dynamic, especially technical, logistical, regulatory, and macroeconomic factors impacting the production economics of future uranium projects. As the uranium industry transitions into 2025, the PCI cohort will ratchet forward to reflect a nuanced cohort of future projects that is considerably different than the cohort that constituted much of the PCI analysis in 2024.

Chief among the various reasons cited for revising production targets for certain projects downward in 2024 were technical and operational issues. From 2025, with most idled operations restarted and therefore removed from the PCI analysis, the scope of risk narrows its focus on newly emerging projects. Many of those proposed operations are not fully permitted, and none are sufficiently financed to build their operations using cash alone.

From January 2025, the PCI value will reflect the cost and production profiles of (re)emerging uranium projects deemed competitive—and capable—of delivering into a new 2027-2032 window (previously 2026-2031). With respect to the full spectrum of projects now competing in the market from 2025, TradeTech has revisited its assessment concerning the likelihood and the consequences of risk affecting the production schedules and mining economics of future projects.

Editor’s Note: This PCI analysis is abridged from an “In Focus” article published in the December 31, 2024 issue of TradeTech’s Nuclear Market Review. [top]

October 23, 2024 - TradeTech President Treva Klingbiel Welcomed as Keynote Speaker for Global Uranium Conference

TradeTech President Treva Klingbiel opened the Global Uranium Conference in Adelaide, Australia on October 23, 2024, with her presentation entitled “Nuclear Fuel Market Fundamentals: A New Start,” which focused on the key driver of uranium demand today—the growing need for clean energy.

Government policies worldwide have evolved to acknowledge and support nuclear power's critical role in achieving carbon reduction goals. “This support stands as recognition that addressing climate change is an immediate concern, and that nuclear power can and must play a role,” Klingbiel told the audience.

While nuclear power currently accounts for nearly 10 percent of global electricity and roughly 30 percent of low-carbon generation, there is a new category of electricity consumer that is set to increase nuclear power’s share. Hyperscalers, such as Amazon, Google, and Microsoft, are in the business of artificial intelligence, cryptocurrency mining, and other large-scale and electricity-hungry IT applications, which require massive datacenters that rely on vast amounts of uninterrupted power. Additionally, and often overlooked, is that nuclear power is crucial for industrial applications, which are leaders in terms of energy consumption. All of these uses for nuclear support the expanded role of nuclear in tomorrow’s energy markets and make nuclear an attractive investment.

The increasing need for clean energy comes at a time when the availability of uranium production from existing supply sources is under great strain. For example, in addition to the trade restrictions levied on Russian nuclear imports into some of the largest markets, large portions of future production are being claimed by China. “Our analysis shows us that the evolving deficit between supply and demand requires that new uranium production is needed well before 2030, and that need grows significantly, even in the most conservative demand scenario,” Klingbiel explained.

When looking at recent uranium prices, a primary driver behind the latest increase in price is perceptions of a primary supply shortage, threats to deliveries, inflation in predicted production costs, and general uncertainty around the availability of future supply. These fundamental concerns have been amplified by geopolitical and logistical risks. [top]

April 11, 2024 - TradeTech President Treva Klingbiel Highlights Uranium Price Trend & Market Developments in Keynote Address for PI Financial Uranium Investors Forum

In the keynote address for the PI Financial Uranium Investors Forum in Toronto, TradeTech President Treva Klingbiel stated that the spot uranium price has trended upward for the last several years, showing notable volatility along the way, which has reflected the diverse interests, expectations, and externalities at play in the market at particular points in time.

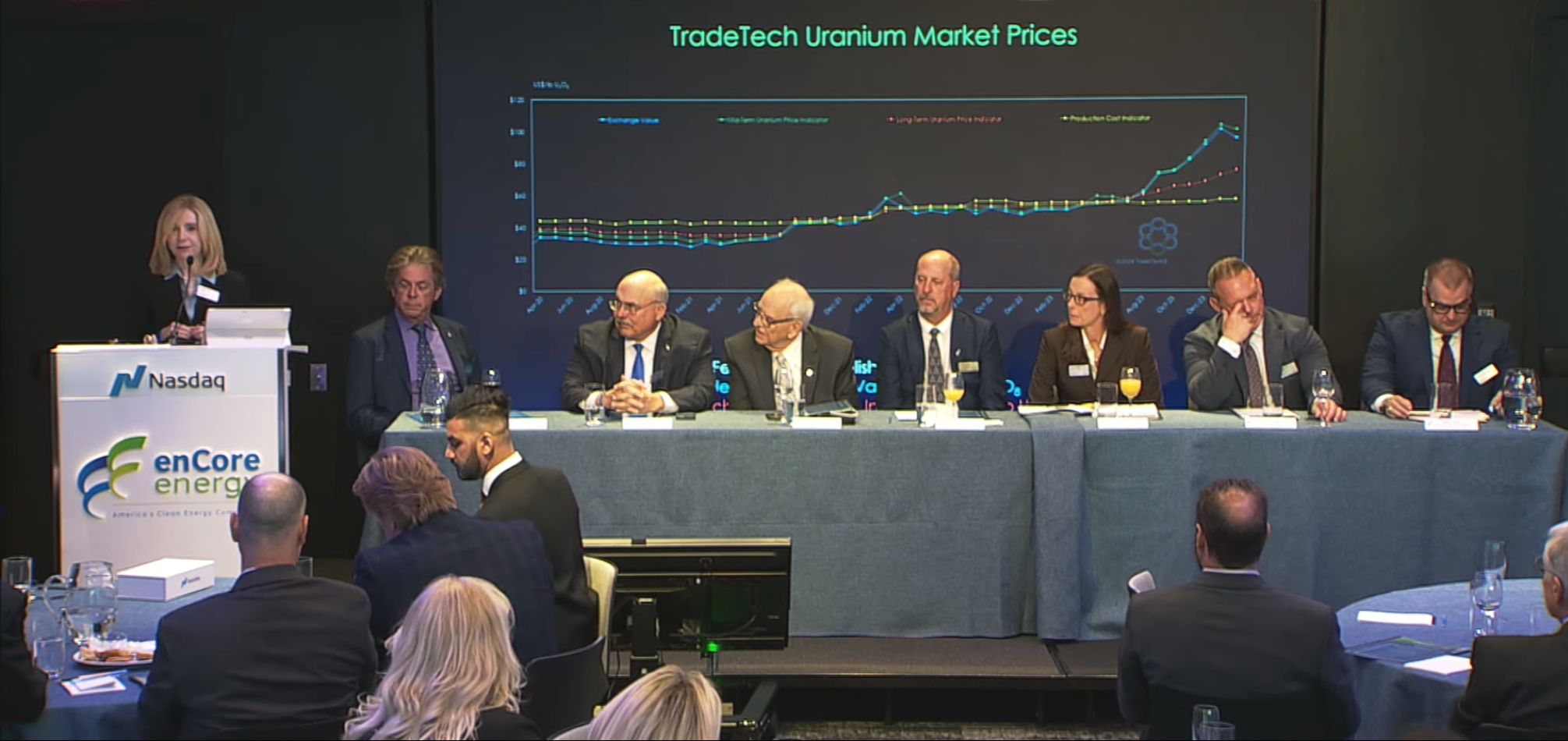

March 25, 2024 - TradeTech’s Treva Klingbiel Participates in enCore Energy’s Inaugural Investor Day

US uranium producer enCore Energy Corp. rang the Nasdaq Opening Bell in New York City on March 25, 2024, which was followed by the company’s first Annual Investor Day.

TradeTech President Treva Klingbiel provided the opening address for the Investor Day event, entitled “Uranium: Fueling the Future.” Her presentation highlighted recent developments and some of the key factors influencing the uranium market, including geopolitical unrest, increasing demand related to climate change initiatives, and uncertainty surrounding Russian nuclear fuel exports, which have increased the attention on domestic and geopolitically friendly sources of uranium supply. enCore Energy’s Investor Day video presentation is available at: https://encoreuranium.com/investor-day/. [top]

March 21, 2024 - Bloomberg: Uranium’s 22% Price Plunge Is Bottoming Out on Nuclear Future

Bloomberg’s Maria Clara Cobo reported on uranium market prices, which despite a 22 percent decline over six weeks, has industry experts and analysts saying that the uranium market has likely set a new floor thanks to a strong demand outlook.

Treva Klingbiel, president of uranium price reporter and industry consultant TradeTech, said she doesn’t see demand for nuclear fuel easing any time soon. “We have a number of geopolitical factors that have a really significant influence on buyer behavior, even though fundamentally nothing has changed” she said. “Buyers can use the spot [market price] to tell them the sentiment of the day but must look at the long-term market to see that it is marching steadily up, it hasn’t taken a hiccup at all." [top]

November 15, 2023 - TradeTech President Treva Klingbiel Delivers Keynote Address for Global Uranium Conference 2023

TradeTech President Treva Klingbiel provided a review of today’s uranium and nuclear fuel markets in her keynote presentation for the Global Uranium Conference 2023 in Adelaide, South Australia, which focused on key factors influencing uranium prices, demand, production, and buying behavior, as well as trends in government policy affecting the global nuclear energy industry.

Klingbiel noted that prices for nuclear fuel, including U3O8, are up significantly. As of October 31, 2023, TradeTech’s uranium spot price had risen 43 percent in the last year, and 150 percent in the last three years. “Today, our Uranium Spot Price Indicator is at its highest level since January 2008. And long-term prices have climbed to historical highs, as well,” she said.

The current rise in market prices is rooted in several developments, including increased demand for uranium related to growing support for nuclear power globally. Governments that are advancing legislation to mitigate the effects of climate change through carbon reduction now often include funding for existing nuclear power plants, advanced nuclear power reactor designs, and domestic supplies of nuclear fuel.

Notably, policy makers are recognizing that nuclear power can contribute in a meaningful way to reducing carbon emissions while also increasing energy security. And, public support for nuclear power is increasing, as well, Klingbiel explained.

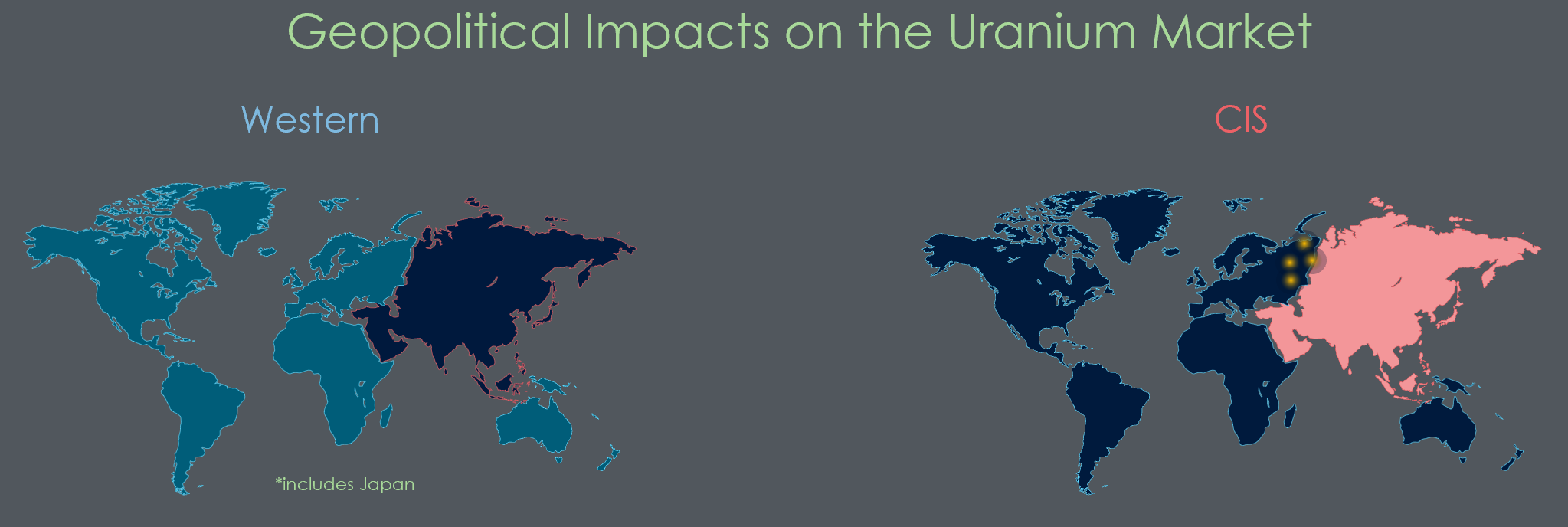

“Today, the market has not only been upset by the shift in prevailing policies, but also by a shift from supply surplus to supply deficit, due in no small part to the disciplined actions of some of the largest suppliers. And, lastly, Russia’s invasion of Ukraine, which has realigned the market. The nuclear fuel market has more than bifurcated, it has splintered into an asymmetrical arrangement of suppliers, buyers, and speculators arranged by alliances,” Klingbiel said. [top]

August 18, 2023 - Unmasking Market Dynamics: Uranium’s Rollercoaster Ride

The uranium market, known for its twists and turns, has been on a rollercoaster ride in recent times. Fluctuations in uranium prices have caught the attention of investors, energy enthusiasts, and analysts alike. This article takes a deep dive into the complex interplay of factors that have driven these price shifts. From supply-demand dynamics to geopolitical tensions and market evolution, we unravel the forces that shape the uranium market, impacting the decisions of various stakeholders.

The heart of uranium’s volatility lies in the delicate equilibrium between supply and demand. As global efforts to transition towards cleaner energy intensify, nuclear power emerges as a viable option. This resurgence in interest has triggered a demand surge, yet supply struggles to keep pace. Geopolitical tensions in key uranium-producing regions have led to disruptions, contributing to supply uncertainties. Moreover, the lengthy process of ramping up production further compounds the challenge, creating a precarious balance between what’s needed and what’s available.

As seen in a recent press release, the uranium market has surged, with TradeTech’s Long-Term Uranium Price Indicator reaching a ten-year high of $57.75 per pound U3O8 in July. This rise aligns with the nuclear power sector’s global efforts to enhance energy security and meet climate goals. Alongside this, there are concerns about potential supply issues due to production delays and rising costs. TradeTech’s monthly uranium Production Cost Indicator also rose by 0.2 percent to $55.30 per pound U3O8 on July 31, marking a 5 percent increase compared to the previous year. This increase hints at the likelihood of upcoming market volatility.

To read the complete article, visit: https://beststocks.com/unmasking-market-dynamics-uraniums-rollercoaster-ride [top]

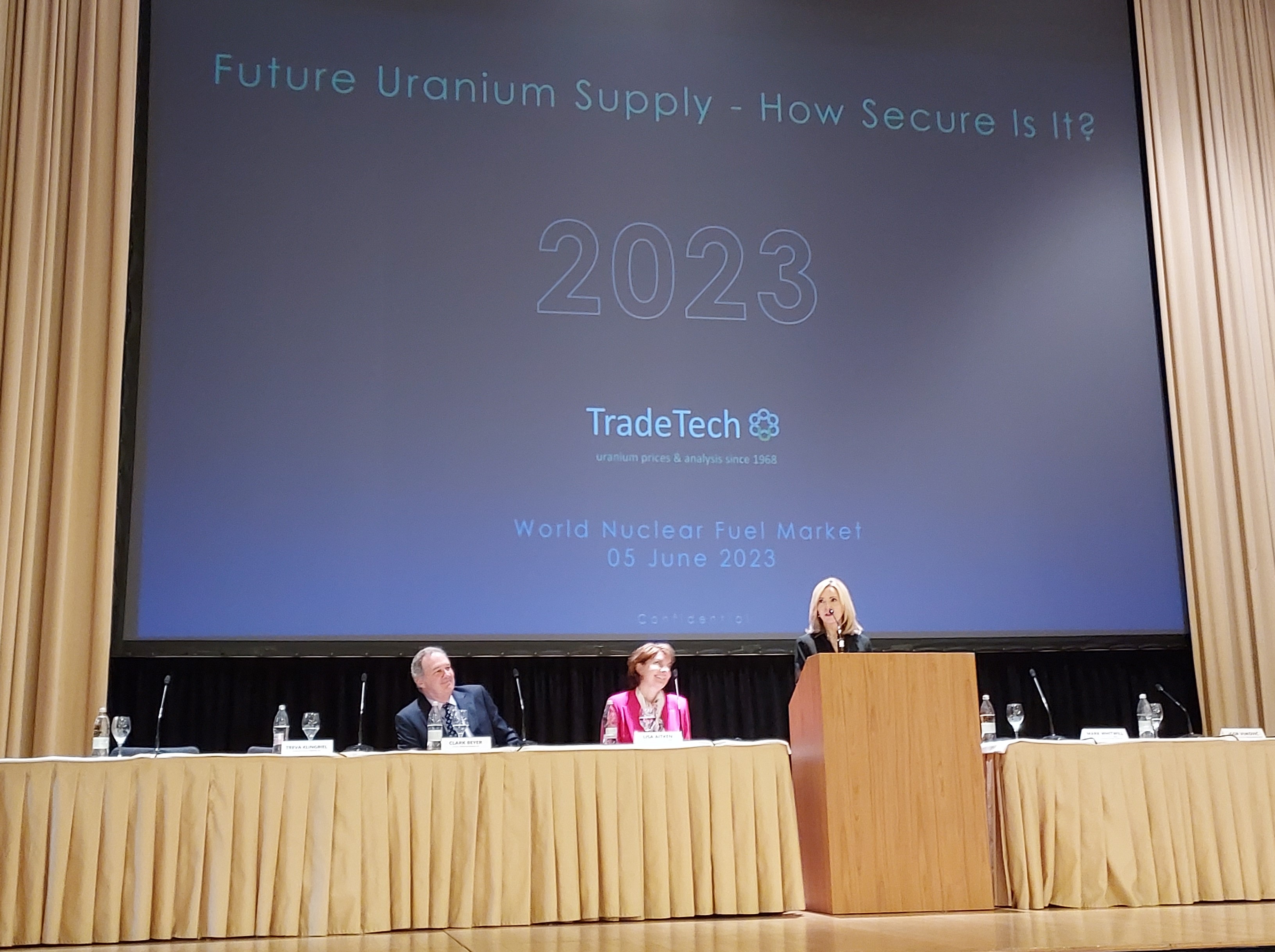

June 6, 2023 - TradeTech President Treva Klingbiel Addresses WNFM International Conference

TradeTech President Treva Klingbiel was invited to speak at the World Nuclear Fuel Market international conference held in Ljubljana, Slovenia on June 4-6, 2023, where her presentation focused on uranium supply. Her presentation—entitled “Future Uranium Supply – How Secure Is It?”—reviewed the uranium market over the past year and where the uranium industry is today, while asking if it is ready for increased future demand as the world looks to nuclear power for sustainable, low-carbon power.

Klingbiel noted that leading into 2022, the uranium market had already identified a structural supply deficit, which was the result of several years of underinvestment in uranium project development. “That existing supply deficit widened in the wake of increased buying by producers themselves, uncertainty around the timing of much needed emerging production, and increased buying among physical funds,” she said.

However, Russia’s invasion of Ukraine amplified an existing situation where the supply/demand balance in each stage of the nuclear fuel cycle was tipping precariously toward, or as in the case of uranium, was already in, deficit. Since then, what the market has seen is a notable decline in interest among utilities to take on any added exposure to Russian nuclear fuel exports. And this shift has occurred as the prospect of formal sanctions looms over the market in several jurisdictions, Klingbiel explained. “While the world is witnessing an historic level of policy support for nuclear power that has emerged in several countries over the past couple of years, the established uranium supply base is shrinking. Therefore, we need to see emerging projects move from development into production,” Klingbiel said. [top]

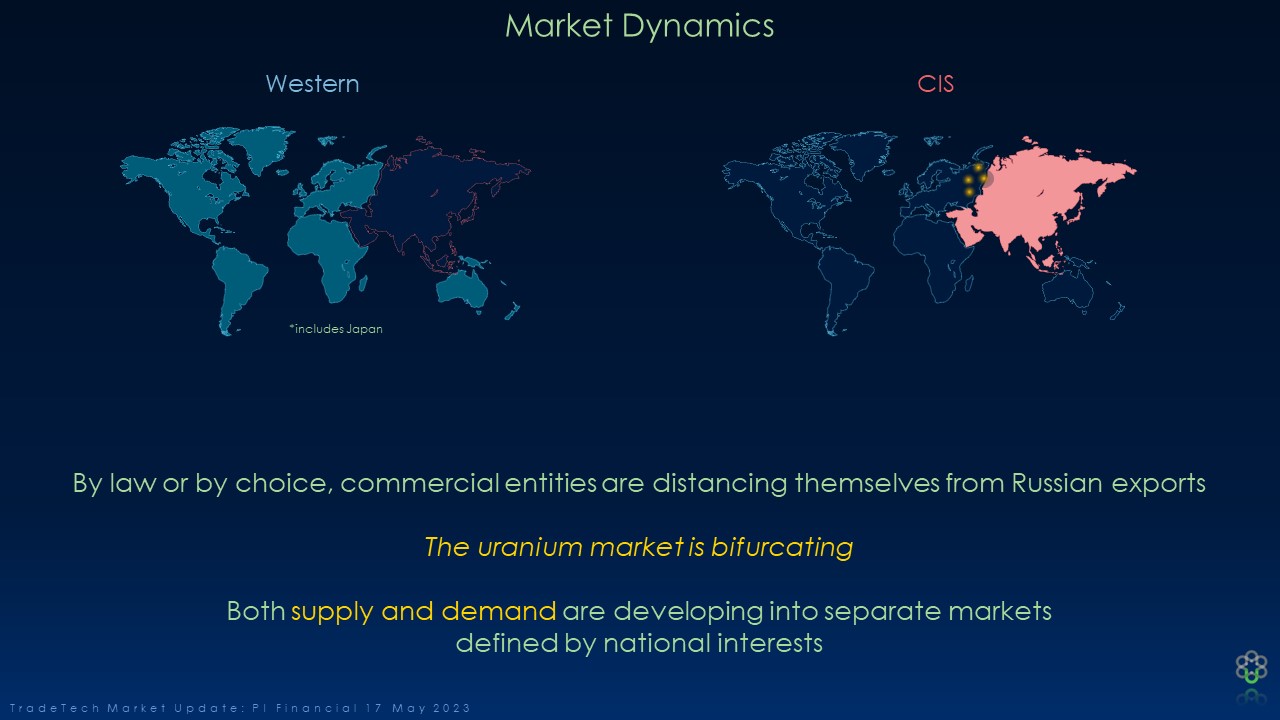

May 17, 2023 - Treva Klingbiel Joins PI Financial Uranium Webinar to Present Uranium Market Update

TradeTech President Treva Klingbiel provided a presentation covering recent developments in the uranium market during a webinar hosted by PI Financial on May 17, 2023 (www.pifinancialcorp.com/capital-markets/webinars-and-conferences). Klingbiel set the stage for the discussion with an overview of TradeTech’s uranium spot price, which recorded historical levels of volatility in 2022, reaching a peak of 47 percent last year and since leveling off at around 29 percent. There has been an even more notable long-term upward trend in the spot price, which has nearly doubled in the last two years.

"We’ve seen support for nuclear power re-emerge in some of the world’s largest markets, which has manifested in two categories: first, policy frameworks that allow for secured capital to flow to new and existing nuclear power programs, and subsidies that include nuclear power as part of initiatives that aim to create carbon-free economies and energy independent programs," Klingbiel said. Notably, policy developments in support of nuclear power come at a time when the nuclear fuel market is faced with a structural supply deficit.

"Russia’s invasion of Ukraine has fundamentally altered the uranium market and it has amplified an existing situation where the supply/demand balance in each stage of the fuel cycle was tipping toward, or was already in, deficit. These developments underscore what we’ve been forecasting since the invasion--that there will be a redrawing of alliances, commitments, and the supply chains, especially surrounding those that impact nuclear fuel. While sanctions against nuclear fuel imports have yet to emerge, there has been a shift in priorities among many buyers from “price first” and more toward “security of supply,” and in some cases even reaches to the level of national security factors," Klingbiel explained. [top]

May 12, 2023 - TradeTech’s Luminita Grancea Joins IAEA Panel to Discuss “Uranium for a Sustainable Future”

Luminita Grancea, Director, Policy & Strategy for TradeTech, joined a panel for the International Symposium on Uranium Raw Material for the Nuclear Fuel Cycle, hosted by the International Atomic Energy Agency in Vienna, Austria on May 8-12, 2023. Grancea’s presentation, “Uranium for a Sustainable Future,” focused on global prospects for nuclear power and the associated uranium requirements.

Grancea noted that capital investments in nuclear technology grew more than 9,000 percent between 2015 and 2022, as interest in large reactors, as well as small modular reactors and advanced reactor designs, continued to gain momentum amid security of energy supply and national and regional commitments to climate goals. She added that all available low-carbon technologies need to be deployed to reach climate targets and nuclear has a role to play. Demand for uranium is projected to be high as it contributes to achieving the “energy transition.” [top]

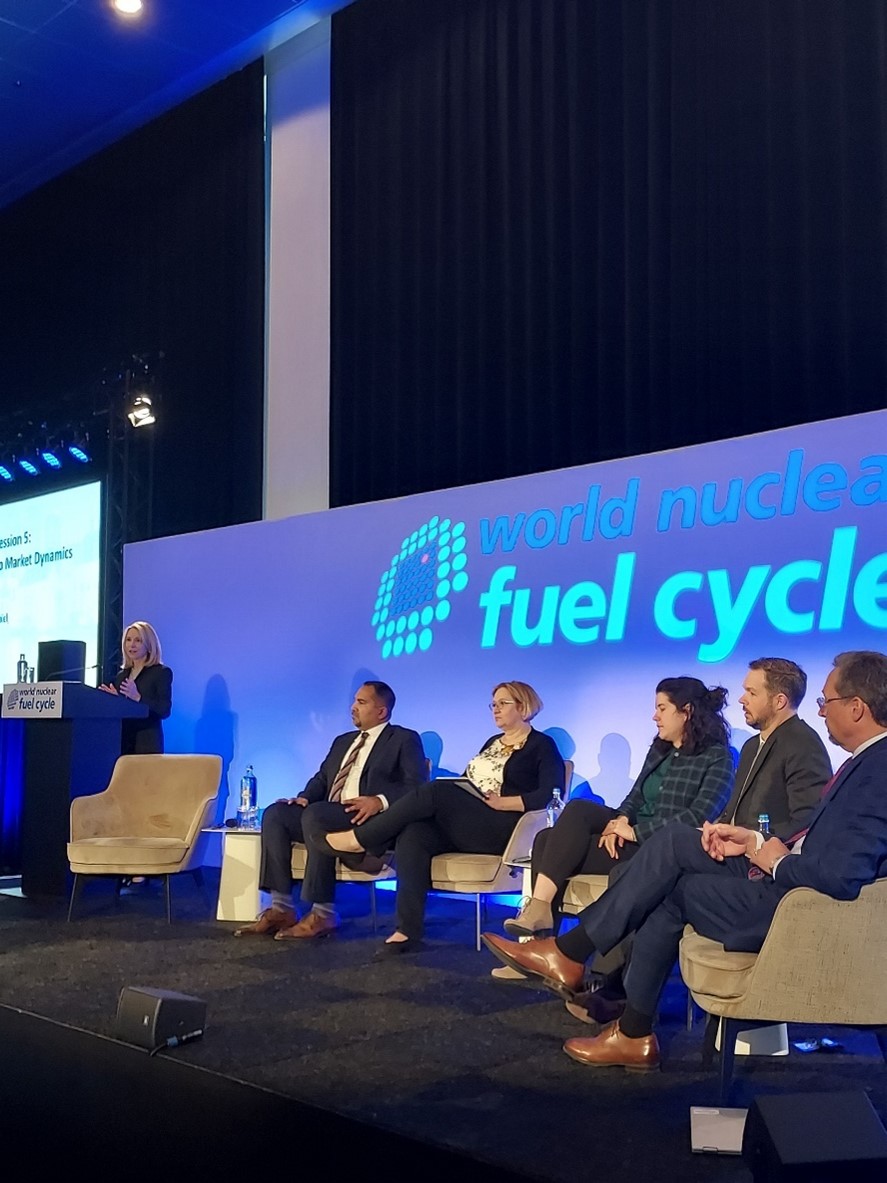

April 20, 2023 - WNFC 2023 Panel Moderated by TradeTech President Treva Klingbiel

TradeTech President Treva Klingbiel introduced a panel of nuclear fuel industry executives who shared their thoughts on uranium market dynamics during the World Nuclear Fuel Cycle 2023 conference in The Hague, the Netherlands on April 20. Klingbiel noted that as the uranium market enters 2023, it is beset by paradoxes. Uranium sales in the term market last year reached record highs, yet the term price remains steadily below the expected cost of new production in the Prime Contracting Period; the fundamentals in the uranium market indicate a deepening supply deficit, yet uranium equity prices are often under downward pressure, subject to inflation and rising interest rates; and both private and public capital is flowing to nuclear power, yet with a few bright exceptions there are few new reactor projects underway in the world’s largest nuclear fuel markets.

What this amounts to in financial terms is a sector with a great deal of promise. And while returns on investment over the last year or so have been unremarkable, returns over the last three to five years have been significant. And this is where the underlying truth of the nuclear fuel markets emerges: nuclear is a long game, it takes years to build reactors and uranium mines, returns on investments are rarely immediate, and the market tends to react to developments over years, not months or quarters. [top]

Oct 27, 2022 - PI Financial Hosts Uranium Fireside Chat with Uranium and Nuclear Industry Expert TradeTech

Vancouver-based investment dealer PI Financial Corp. hosted a “Uranium Fireside Chat” in an online forum on October 27, which featured TradeTech President Treva Klingbiel as the keynote speaker.

The conversation between PI Financial’s Chris Thompson and Ms. Klingbiel covered a range of relevant topics related to the nuclear fuel cycle, including a review of the looming uranium supply deficit and regional nuclear power policies and growth, as well as views on today’s uranium conversion, enrichment, and fabrication sectors.

Klingbiel noted while discussing the current geopolitical impacts on the uranium market that the uranium market is bifurcating. “By law or by choice, commercial entities are distancing themselves from Russian exports and, as a result, this could lead to both the supply and demand sectors transitioning into separate markets defined by national interests,” she stated.

A recording of the online event is available at: https://www.pifinancialcorp.com/capital-markets/analyst-talks [top]

Oct 17, 2022 - TradeTech President Treva Klingbiel Serves as Moderator for NEI Panel

TradeTech President Treva Klingbiel served as the moderator for the opening session of the International Uranium Fuel Seminar, hosted by the Nuclear Energy Institute in Las Vegas, Nevada on October 16-18, 2022.

The session focused on the global growth in nuclear power generation and included presentations on US nuclear power plant uprates and license extensions, as well as a review of South Korea's updated energy policy that will see nuclear power continue to support the nation's energy security and net-zero carbon goals. A presentation by the Nuclear Innovation Alliance looked at the future of small modular and advanced reactors in the future global energy mix.

Another seminar session featured speakers from the North American uranium mining community and provided notable insights into the challenges and opportunities associated with the (re) emerging uranium supply sector today. [top]

Jun 7, 2022 - TradeTech President Treva Klingbiel Joins WNFM Panel Discussion

TradeTech President Treva Klingbiel joined a high-level panel of nuclear utility and uranium mining executives during the 48th annual World Nuclear Fuel Market conference in Montreal, Canada, on June 7, where the discussion focused on strategies to manage the new paradigm in today's nuclear fuel market.

Apr 27, 2022 - TradeTech President Treva Klingbiel Moderates WNFC Session: Uranium Mining – Today & Tomorrow

TradeTech President Treva Klingbiel served as the moderator for a session during the World Nuclear Fuel Cycle conference in London on April 27, 2022, which focused on uranium mining in today’s market and the challenges that lie ahead.